Three-Way Matching Solutions

Home » Solutions » Procure to Pay » Accounts Payable » Three Way Matching

Increase accuracy, line match rates and accounts payable automation

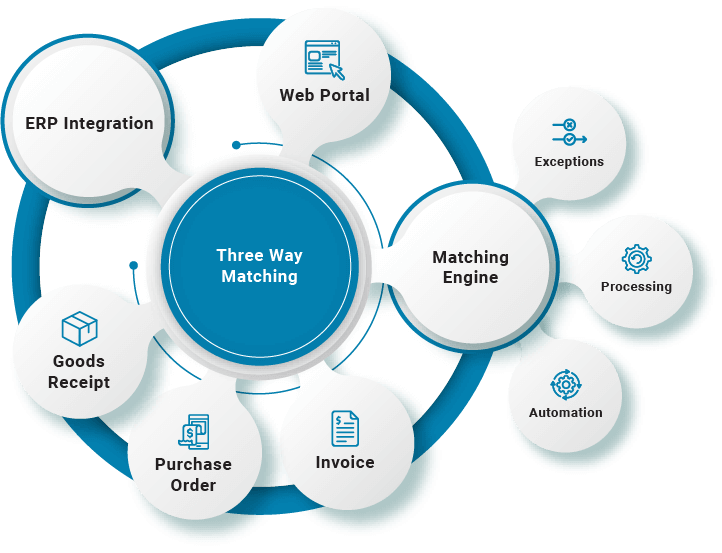

B2BE’s Three-Way Matching solution gives you full control over your accounts payable processes to ensure you’re paying suppliers the right amount and when you need to. Invoices are matched with goods receipts and purchase orders and using B2BE’s Accounts Payable AI intelligent matching means errors can be eliminated in the pre-processing stage, anomalies with the way you buy and the supplier sells can be automatically managed to maximise line matching and reduce human intervention.

Of course the system can also allow manual intervention if needs be to balance, query and reject invoices, if need be, so your accounts payable team only needs to deal with the real exceptions and the rest remains automated.

Key features of B2BE's Three-Way Matching solution

Increase first time match rates

Pay suppliers the right amount at the right time

Incorrect payments means more effort to manage and remedy. B2BE’s Three-Way Matching solution means you will not only pay suppliers more efficiently you will not pay the wrong supplier the wrong amount. B2BE’s AI and validation approach means invoices are processed accurately and quickly so when you do your payment proposal run you will only be paying what you need to and at the right time.

Don't pay duplicate or incorrect invoices

Duplicate invoices are problematic as you don’t want to pay for goods twice and they aren’t always easy to pick-up, particularly when you have a decentralised accounts payable environment. B2BE’s Three-Way Matching solution can easily identify duplicate invoices so they aren’t processed and paid twice.

Three-way debit process

Three-way credit process

Settlement discount management

e-Invoice document management

B2BE Three-Way Matching workflow

B2BE’s Three-Way Matching solution gives you full control over your accounts payable processes to ensure you’re paying suppliers the right amount and when you need to.