Mitigating Global Supply Chain Risks Through Technology and Strategy

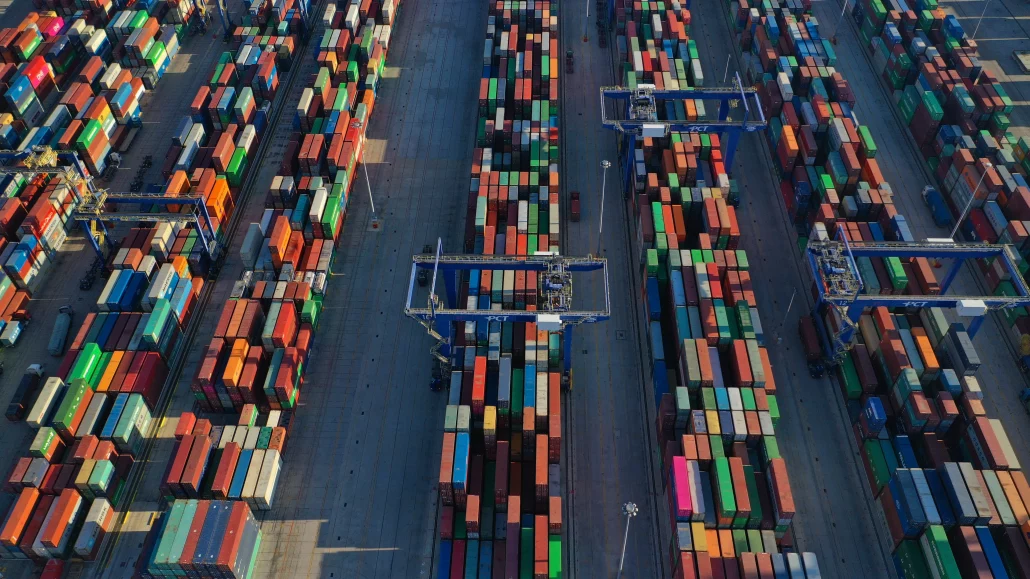

Global supply chain risks have become a major concern for businesses in today’s unpredictable environment. Disruptions caused by geopolitical tensions, economic shifts, and climate-related events can impact operations and profitability. To stay competitive, organisations need strategies that combine technology and proactive planning. Understanding Global Supply Chain Risks Global supply chain risks include delays, cost fluctuations, […]

Mitigating Global Supply Chain Risks Through Technology and Strategy Lire la suite »